The Sole Proprietorship

Exploring the Sole Proprietorship

The Simplest Choice

The entrepreneurial spirit ignites, dreams take flight, and the journey to building your own business begins. But before diving headfirst, a crucial decision awaits: choosing the right business structure. Among the various options, the sole proprietorship beckons with its simplicity. But is it the perfect fit for your venture? Let’s delve into the world of sole proprietorships, exploring its advantages, limitations, and ideal scenarios to help you make an informed decision.

Understanding the Sole Proprietorship:

A sole proprietorship is the most basic and straightforward business structure. It’s essentially an extension of yourself, where you, the owner, manage and operate the business entirely. There’s no legal distinction between you and the business; you are one and the same. This translates to:

- Easy Setup: Minimal formalities are involved. There’s often no need for registration (depending on your location and industry), allowing you to start operating quickly.While official registration isn’t mandatory, obtaining tax registrations (Professional Tax and GST) and registering under the Shop and Establishment Act are recommended to establish your business presence.

- Sole Ownership and Control: You call the shots! All decisions, profits, and losses belong solely to you.

- Pass-through Taxation: Business profits and losses “pass through” to your personal tax return, eliminating the need for a separate tax filing for the business.

Advantages of a Sole Proprietorship:

- Simplicity and Low Cost: The ease of setup and minimal ongoing fees make it an attractive option for low-risk, small-scale businesses.

- Complete Control: You have the freedom to make all business decisions without having to answer to partners or shareholders.

- Flexibility: Adapting to market changes or new opportunities is easier as there’s no complex internal approval process.

- Keeps Profits: All business profits flow directly to you, maximizing your personal financial gain.

Limitations of a Sole Proprietorship:

- Unlimited Liability: This is the biggest drawback. Since there’s no separation between you and the business, your personal assets (home, car, etc.) are at risk if the business incurs debts or gets sued.

- Limited Growth Potential: Raising capital can be challenging under a sole proprietorship structure. Investors may be hesitant due to the unlimited liability factor.

- Limited Access to Benefits: As a sole proprietor, you’re typically not eligible for employee benefits like health insurance or paid time off that traditional employees enjoy.

- Tax Implications: Self-employment taxes apply, meaning you’ll pay Social Security and Medicare taxes on your business profits.

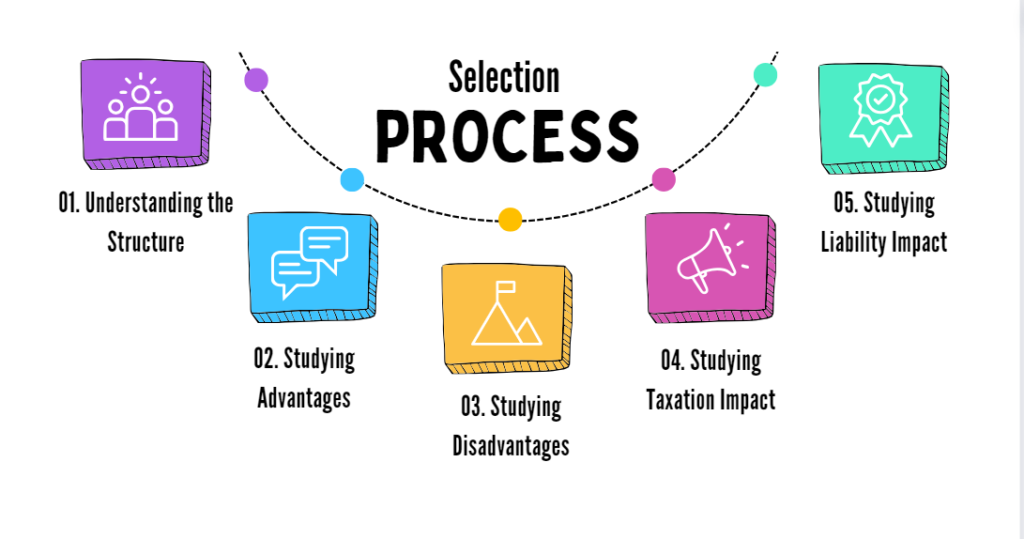

Making an Informed Decision:

Choosing the right business structure requires careful consideration.

Here are some questions to ask yourself:

- What is the level of risk associated with my business? If there’s a high risk of lawsuits or debts, a sole proprietorship might expose your personal assets too much.

- Do I plan on seeking investors or growing the business significantly? If so, a structure like an LLP might offer greater flexibility for attracting investment.

- Do I need employee benefits for myself? Sole proprietorships typically don’t offer the same benefits as other structures.

However, remember the unlimited liability aspect and consider your future plans. If you envision significant growth or want to protect your personal assets, transitioning to a different structure like a Limited Liability Company (LLC) might be necessary later.

Consulting a Chartered Accountant or tax advisor is recommended to understand the legal and tax implications of a sole proprietorship and ensure you’re complying with all relevant regulations in India.

Differentiate The Sole Proprietorship From A Partnership & Company

Here’s a breakdown of the key differences between a sole proprietorship, partnership, and company:

Ownership and Control:

- Sole Proprietorship: One individual owns and controls the business. All decisions, profits, and losses belong solely to them.

- Partnership: Two or more people (partners) co-own and manage the business. Ownership percentages, profit sharing, and management responsibilities are outlined in a partnership agreement.

- Company: Ownership is divided into shares held by shareholders. A board of directors, elected by shareholders, oversees the company’s management, and professional managers run the day-to-day operations.

Liability:

- Sole Proprietorship: Unlimited liability. The owner’s personal assets (house, car, etc.) are at risk if the business incurs debts or gets sued.

- Partnership: Generally, unlimited liability. Partners share responsibility for business debts and can be held personally liable if the business cannot fulfill its obligations. Agreements can specify varying degrees of liability for each partner.

- Company: Limited liability. The company is a separate legal entity from its shareholders. Their personal assets are generally shielded from business debts, offering greater protection.

Formation and Taxation:

- Sole Proprietorship: The easiest and least expensive to form. Often, no official registration is required (depending on location and industry). Business profits and losses “pass through” to the owner’s personal tax return.

- Partnership: A partnership agreement outlining ownership, profit sharing, and management is essential. Filing requirements vary by location. Similar to a sole proprietorship, partnership profits and losses “pass through” to individual partner tax returns.

- Company: The most complex and expensive to form, requiring legal documents like articles of incorporation and adherence to corporate regulations. Companies file separate tax returns from their shareholders. Profits are taxed first at the corporate level (corporate tax) and then again as dividends distributed to shareholders (personal income tax). This is known as double taxation.

Management and Flexibility:

- Sole Proprietorship: The owner makes all decisions, offering complete control but also placing the entire burden of management on them.

- Partnership: Decisions are typically made jointly by partners as per the agreement. This can lead to disagreements or slow decision-making, but also allows for shared expertise and perspectives.

- Company: Management is separated from ownership. The board of directors sets the overall direction, and professional managers handle daily operations. This structure offers a clear separation of duties and can be more scalable for larger businesses.

Suitability:

- Sole Proprietorship: Ideal for freelancers, independent contractors, and small, low-risk businesses with a single owner.

- Partnership: Well-suited for businesses with co-founders who share skills, expertise, and want to collaborate in decision-making.

- Company: Best for larger, complex businesses seeking to raise capital through stock issuance. Offers limited liability and a structure that can adapt to growth.

Choosing the Right Structure:

The best structure for your business depends on your specific needs and goals. Consider factors like liability protection, growth potential, management style, and tax implications. Consulting with a lawyer or accountant can provide valuable guidance in making this crucial decision.

Do I Need A Lawyer To Choose This Business Structure In India?

No, you don’t necessarily need a lawyer to choose a business structure like a sole proprietorship. Here’s why:

- Simplicity of Sole Proprietorship: Setting up a sole proprietorship is the most straightforward business structure. There are often minimal legal formalities involved, depending on your location and industry. In many cases, you can simply start operating under your own name without needing official registration.

- Available Resources: There’s a wealth of information available online and from government agencies like the Small Business Administration (SBA) that can guide you through the process of choosing and establishing a sole proprietorship. These resources can explain the basic requirements, tax implications, and steps involved.

However, there are situations where consulting a lawyer might be beneficial:

- Complexities in Your Business: If your business involves unique aspects, high risks, or operates in a heavily regulated industry, a lawyer can advise you on potential legal considerations and ensure you’re complying with all regulations.

- Partnership or Corporation Considerations: If you’re contemplating a partnership or corporation structure, these require more complex legal documents and formalities. A lawyer can assist with drafting partnership agreements, articles of incorporation, and navigating the formation process.

- Specific Legal Concerns: If you have specific questions or concerns about liability, taxation, or intellectual property related to your business, consulting a lawyer can provide tailored advice and ensure you’re on solid legal footing.

Here’s a breakdown to help you decide:

When a Lawyer Might Not Be Necessary:

- You’re a solo entrepreneur with a low-risk business.

- You’ve thoroughly researched sole proprietorship requirements and feel comfortable navigating the process.

- You have access to clear and reliable resources from government agencies or reputable business websites.

When Consulting a Lawyer Might Be Wise:

- You have a complex business idea or operate in a highly regulated industry.

- You’re considering a partnership or corporation structure.

- You have specific legal concerns related to liability, taxation, or intellectual property.

- You want peace of mind and assurance that your chosen structure aligns with your business goals.

Ultimately, the decision rests with you. If you have any doubts or feel the need for extra legal guidance, consulting a lawyer is always a safe bet.

Can I Change My Business Structure Later?

Yes, you can change your business structure from a sole proprietorship to another form like a Limited Liability Company (LLC) or a partnership later in India. However, it’s not as straightforward as flipping a switch. Here’s a breakdown of what to consider:

Reasons for Changing Structure:

- Limited Growth Potential: As a sole proprietorship, raising capital or expanding significantly can be challenging. Changing to an LLP or a partnership can offer more flexibility in these aspects.

- Limited Liability Protection: The unlimited liability of a sole proprietorship can be a major concern. Transitioning to an LLP shields your personal assets from business debts and lawsuits.

- Shared Ownership and Management: If you want to bring in partners with skills and resources, a partnership structure becomes more suitable.

Process of Changing Structure:

- Choose the New Structure: Carefully evaluate your needs and choose the most suitable structure (LLP, partnership, etc.).

- Compliance with New Structure: Understand the legal and tax requirements associated with the new structure. This might involve registering the new business entity, obtaining necessary licenses, and following specific accounting practices.

- Transferring Assets and Liabilities: The process of transferring assets and liabilities from the sole proprietorship to the new business entity needs to be documented and completed legally. This might involve tax implications and require consulting a professional.

- Tax Considerations: There might be tax implications associated with the change in structure. Consulting a tax advisor is crucial to understand potential tax liabilities and ensure a smooth transition.

Challenges and Considerations:

- Costs Involved: Changing business structure can incur legal and accounting fees. There might also be tax implications depending on the chosen structure.

- Time Commitment: The transition process can take time, involving paperwork, registrations, and potentially approvals from authorities.

- Professional Guidance: Considering the complexities involved, consulting a lawyer, chartered accountant, or tax advisor specializing in business structure transitions is highly recommended. They can guide you through the process, ensure compliance, and minimize potential risks.

Before You Change:

- Evaluate Your Needs: Carefully assess if changing the structure is truly necessary for your business goals. A sole proprietorship can still be sufficient for many small businesses.

- Consult Professionals: Discuss your situation with a lawyer and a tax advisor. They can help you understand the pros, cons, and legal/tax implications of changing structures.

Conclusion:

While changing your business structure from a sole proprietorship is possible, it requires careful planning, professional guidance, and an understanding of the associated costs and complexities. Make an informed decision based on your business needs and future goals.

What Is The Procedure For Forming A? What Are The Steps Involved?

The beauty of a sole proprietorship lies in its simplicity. Here’s a breakdown of the steps involved in forming one (remember, specific requirements might vary depending on your location):

Forming a Sole Proprietorship in India

The good news is that setting up a sole proprietorship in India is relatively simple compared to other structures. Here’s a breakdown of the steps involved:

- Choose a Business Name:

- While not mandatory, using a business name distinct from your own can provide a professional image. Check for name availability with the Ministry of Corporate Affairs (MCA) online portal to avoid conflicts.

- Obtain Necessary Licenses and Permits:

- Depending on your industry and location, you might need specific licenses or permits to operate legally. Research the requirements for your industry through government websites or local authorities.

- Common examples include a Shop and Establishment Act (S&E) registration, specific trade licenses (e.g., for food service or construction), or professional licenses (for doctors, lawyers, etc.).

- PAN Card:

- Ensure you have a Permanent Account Number (PAN) card, which is a mandatory requirement for filing income tax returns in India.

- Bank Account (Optional):

- Having a separate business bank account is highly recommended. It helps track income and expenses and separates your personal finances.

Additional Tips:

- Register for GST (if applicable): If your business involves selling taxable goods or services, you’ll need to register for GST..

- Business Insurance: Consider liability insurance or other business insurance policies to protect yourself from potential risks.

Remember, these are general guidelines. Always check with your state and local government websites for specific requirements and regulations applicable to sole proprietorships in your area.

What Are The Tax Implications Of This Business Structure In India?

Here’s a breakdown of forming a sole proprietorship in India, focusing on the procedures and tax implications:

Tax Implications of a Sole Proprietorship in India

Sole proprietorships in India follow a “pass-through” taxation system:

- Income Tax:

- Your business profits are added to your personal income and taxed according to the income tax slab rates applicable in India.

- You’ll file Income Tax Return (ITR) 3 along with your personal tax return to report your business income and expenses.

- Advance Tax:

- You’re responsible for paying advance tax throughout the year based on your estimated income. This helps avoid penalties at the time of filing your ITR.

- Goods and Services Tax (GST):

- If your business turnover exceeds the threshold set by the government (currently ₹40 lakh per year), you’ll need to register for GST and collect and deposit tax on your sales.

Additional Considerations:

- Recordkeeping: Maintain accurate records of your business income and expenses for tax filing purposes.

- Professional Advice: Consulting a tax advisor familiar with sole proprietorship taxation in India can be beneficial. They can guide you on complying with tax regulations, maximizing deductions, and minimizing your tax liability.

Remember, these are general guidelines. Always check with the Ministry of Corporate Affairs (MCA) and local authorities for specific requirements and regulations applicable to sole proprietorships in your area.

What Are The Filing Fees Associated With This Structures In India?

While there’s no single “filing fee” associated with a sole proprietorship in India, there can be some costs involved during the setup process. Here’s a breakdown:

- No Mandatory Registration Fee: The good news is that there’s no central government registration fee specifically for sole proprietorships in India.

- Potential Costs to Consider:

- Shop and Establishment Act (S&E) Registration: Depending on your location and the size of your business, registering under the S&E Act might be mandatory. Fees vary by state and shop size but are generally minimal (around ₹100 to ₹500).

- Licenses and Permits: Obtaining specific licenses or permits required for your industry can incur fees. Research the specific licenses needed for your business and associated fees with the relevant authorities. Examples include a food safety license, a pollution control certificate, or a fire safety certificate.

- GST Registration: If your annual turnover exceeds ₹40 lakh, you’ll need to register for Goods and Services Tax (GST). There’s no upfront fee for registration, but ongoing compliance involves filing returns and potentially incurring tax based on your sales.

- Professional Fees: If you seek assistance from a consultant or chartered accountant for setting up your business or navigating compliance procedures, they might charge professional fees.

General Range of Costs:

It’s difficult to provide a precise figure as costs vary depending on your location, industry, and specific needs. However, for a small sole proprietorship, the total setup costs (excluding professional fees) could typically range from a few hundred rupees to a few thousand rupees.

Here are some resources to help estimate potential costs:

- Government Websites:

- MCA website (https://www.mca.gov.in/content/mca/global/en/home.html) might offer information on fees associated with S&E registration or other business registrations.

- Your state government’s websites might provide details on S&E Act registration fees and other local regulations.

- Industry Associations: Industry bodies like CII or FICCI might have resources or publications that provide insights into typical fees for licenses or permits relevant to your industry.

Remember:

These are general pointers. Always check with local authorities and relevant government websites for the latest information on fees and registration requirements applicable to your specific location and business activity in India.

Are There Any Ongoing Reporting Requirements In India For This Structure?

Yes, even though a sole proprietorship in India doesn’t require formal registration, there are still some ongoing reporting requirements to comply with tax and other regulations. Here’s a breakdown of what you’ll need to consider:

Tax Filing:

- Income Tax Return (ITR): As a sole proprietor, your business income “passes through” to your personal income tax return. You’ll need to file the appropriate ITR form (typically ITR 3) along with your personal tax return, reporting your business income and expenses to calculate your taxable income.

- Advance Tax: Similar to estimated tax payments in the US, you might be responsible for paying advance tax throughout the year based on your estimated income. This helps avoid penalties when filing your final ITR.

GST (Goods and Services Tax):

- Registration: If your business turnover exceeds the threshold set by the government (currently ₹40 lakh per year), you’ll need to register for GST. This involves collecting and depositing tax on your sales.

- GST Returns: Registered businesses need to file GST returns electronically at regular intervals (typically monthly or quarterly) depending on their turnover. These returns report sales, purchases, and tax liability.

Other Potential Reporting:

- Shop and Establishment Act (S&E) Registration: While not mandatory nationwide, some states might require registering under the S&E Act if your business meets specific criteria (e.g., employee count, shop size). This might involve annual renewal and potentially some reporting requirements depending on the state.

- Licenses and Permits: Depending on your industry, you might need specific licenses or permits to operate legally. These might have renewal requirements and associated reporting, if applicable.

General Recommendations:

- Maintain Accurate Records: It’s crucial to maintain proper records of your business income and expenses for tax filing purposes. This includes receipts, invoices, bank statements, and purchase records.

- Consult a Tax Advisor: Considering the complexities of tax regulations and potential GST implications, consulting a tax advisor familiar with sole proprietorships can be beneficial. They can guide you on filing requirements, tax calculations, and ensure you’re complying with all relevant regulations.

Remember:

These are general guidelines. Specific reporting requirements can vary depending on your location, industry, and the licenses or registrations applicable to your business. It’s always recommended to check with the local tax authorities, relevant government departments, and industry associations for the latest information on reporting requirements for sole proprietorships in your area of operation.

Ideal Scenarios For Choosing This Structure In India.

The simplicity and low cost of setting up a sole proprietorship make it an attractive option for many aspiring entrepreneurs in India. However, it’s not a one-size-fits-all solution. Here’s a closer look at scenarios where a sole proprietorship might be the ideal structure for your business in India:

1. Small-Scale Businesses with Low Risk:

- This structure is well-suited for businesses with minimal startup costs and limited liability exposure. Examples include:

- Freelancers and Independent Contractors: Individuals offering services like writing, consulting, or web design can thrive under this structure.

- Small Retail Shops: Local stores selling everyday goods or offering basic services (e.g., tailoring, stationery) can operate efficiently as sole proprietorships.

- Home-Based Businesses: Businesses like online tutoring, bakery operations from home, or handicraft production can comfortably function as sole proprietorships.

2. Businesses You Operate From Home:

- Many home-based businesses in India, especially those in their initial stages, can benefit from the ease of setting up a sole proprietorship. This allows them to focus on establishing their brand and client base without the complexities of other structures.

3. Exploring a Business Idea:

- If you’re testing the waters with a new business concept, a sole proprietorship offers a low-risk entry point. You can start small, gauge market response, and then decide if you need to scale up and adopt a different structure later.

4. Businesses with Limited Growth Potential:

- Sole proprietorships are well-suited for businesses that you envision remaining relatively small and manageable by a single owner. If you don’t have plans for large-scale expansion or attracting significant investment, this structure can provide sufficient flexibility.

5. Businesses Where Complete Control is Desired:

- As the sole owner, you have complete control over all aspects of the business, from decision-making to day-to-day operations. This can be a major advantage for entrepreneurs who have a clear vision and prefer to manage everything themselves.

Additional Considerations in India:

- Tax Benefits: For some small businesses, the simplicity of filing personal income tax returns with business income included can be an advantage.

- Compliance Burden: While relatively simple to set up, sole proprietorships still need to comply with regulations related to licenses, permits, and tax filings.

Remember:

A sole proprietorship is a great starting point for many businesses in India. However, consider the limitations, especially regarding liability and growth potential. Carefully assess your business goals, risk tolerance, and future plans before deciding on this structure. Consulting with a tax advisor or chartered accountant can provide valuable guidance tailored to your specific situation in India’s business environment.

Where Can I Find More Information On This Business Structures In India?

Here are some resources in India where you can find more information on business structures, including sole proprietorships:

Government Websites:

- Ministry of Corporate Affairs (MCA): The official website of the MCA (https://www.mca.gov.in/content/mca/global/en/home.html) provides a wealth of information on business registration, regulations, and various business structures. They offer downloadable resources and FAQs to guide entrepreneurs.

- Startup India: A government initiative aimed at fostering entrepreneurship in India (https://www.startupindia.gov.in/). Their website offers resources on different business structures, including a guide to choosing the right structure for your startup.

Professional Organizations:

- Confederation of Indian Industry (CII): A major industry association in India (https://en.wikipedia.org/wiki/Confederation_of_Indian_Industry). Their website might offer resources or publications related to business structures and legalities.

- FICCI (Federation of Indian Chambers of Commerce and Industry.

Additional Resources:

- MSME (Micro, Small and Medium Enterprises) Development Institute: A government initiative supporting MSMEs in India (https://dcmsme.gov.in/). They might offer resources or workshops related to business structures for small businesses.

- Consult a Chartered Accountant (CA) or Tax Advisor: These professionals can provide personalized advice based on your specific business goals and financial situation. They can help you understand the pros and cons of different business structures and choose the one that best suits your needs.

Remember, this list is not exhaustive. Many other resources are available online and through professional organizations in India. By consulting these resources and seeking professional guidance if needed, you can make an informed decision about the best business structure for your venture in India.

An Indian Case Study Of This Business Structure.

Mumbai Masala House – A Thriving Sole Proprietorship

Background:

Mumbai Masala House is a popular spice shop located in the bustling Crawford Market of Mumbai, India. Started in 1995 by Mrs. Lakshmi Shah, the shop has carved a niche for itself by offering high-quality, freshly ground spices and unique spice blends.

Business Structure:

Mumbai Masala House operates as a sole proprietorship. Mrs. Shah is the sole owner and manages all aspects of the business, from sourcing spices to customer interaction and daily operations.

Advantages of Sole Proprietorship for Mumbai Masala House:

- Simplicity and Low Cost: Setting up a sole proprietorship was a simple and affordable option for Mrs. Shah. This allowed her to launch her business quickly without complex legal formalities.

- Complete Control: Mrs. Shah has complete control over all aspects of the business. She can make quick decisions about sourcing, pricing, and product offerings based on customer preferences and market trends.

- Direct Profits: As the sole owner, all profits from the business go directly to Mrs. Shah, allowing her to reinvest in the business or use it for personal needs.

Challenges of Sole Proprietorship:

- Limited Growth Potential: The structure might limit future growth. Expanding to new locations or significantly increasing production could be difficult with a single owner managing everything.

- Unlimited Liability: Mrs. Shah’s personal assets are at risk if the business incurs debts or gets sued. This can be a significant concern, especially as the business grows and attracts more customers.

- Limited Access to Capital: Raising capital for expansion or investment might be challenging as a sole proprietorship. Banks and investors might be hesitant due to the lack of a separate legal entity and unlimited liability.

Future Considerations:

As Mumbai Masala House enjoys continued success, Mrs. Shah might consider transitioning to a different business structure in the future. Here are some possibilities:

- Limited Liability Company (LLC): An LLC could offer limited liability protection while retaining some of the simplicity of a sole proprietorship. This structure might be suitable if Mrs. Shah wants to expand the business to new locations.

- Partnership: Taking on a partner with complementary skills and resources could help manage the workload and fuel further growth. However, this would involve sharing profits and decision-making power.

Conclusion:

The sole proprietorship structure has been instrumental in the success of Mumbai Masala House. However, as the business matures, Mrs. Shah will need to evaluate her goals and consider alternative structures that can support future growth while managing risks effectively. This case study highlights both the advantages and limitations of a sole proprietorship for a small business in India.

Beyond the Sole Proprietorship:

While the sole proprietorship offers a simple solution, it’s not the only option. Consider exploring other structures like:

- Limited Liability Company (LLC): Offers limited liability protection while retaining some of the simplicity of a sole proprietorship.

- Partnership: For businesses with multiple owners who share management and profits. However, partners also share unlimited liability.

- Company: The most complex structure, best suited for large businesses seeking to raise capital. Offers limited liability and a separate legal identity from its owners.

Conclusion:

The sole proprietorship is a great starting point for many aspiring entrepreneurs. Its simplicity, low cost, and complete control are attractive. However, understand the limitations, especially regarding liability and growth potential. Carefully assess your business goals and risk tolerance before making a decision. Remember, consulting with a lawyer or accountant can provide further guidance tailored to your specific situation.

Accordion title 2

This is a placeholder tab content. It is important to have the necessary information in the block, but at this stage, it is just a placeholder to help you visualise how the content is displayed. Feel free to edit this with your actual content.

Recent Comments